2019 Fellow Aaron Pickard Breaks Down the Latest Commercial Space Industry Announcements

By Aaron Pickard, 2019 Matthew Isakowitz Fellow

2019 Fellow Aaron Pickard, who is currently an Assembly, Integration and Test Engineer at Tyvak.

The last week of October had lots of exciting news in the space industry. Among many scientific and technical announcements, Vector emerged from bankruptcy, the Federal Communications Commission approved the sale of OneWeb to a consortium of the UK Government and Bharti Global Limited, Ansys announced its intention to acquire Analytical Graphics, Inc., and Redwire publicized its acquisition of Roccor. These last two transactions are particularly interesting as they represent new types of exits in the commercial space sector.

As the industry matures, it is becoming more mainstream, and appealing to a wider variety of investors. One type of exit that companies choose to pursue, in which they raise capital from as many potential investors as possible, is to "go public", and become publicly traded on a stock exchange. Virgin Galactic (SPCE:NYSE), for example, went public in Fall 2019. This was accomplished through a merger with a Special Purpose Acquisition Company ("SPAC"). A SPAC is a way for investors to collectively finance an acquisition by buying shares of a shell company created specifically to acquire a to-be-identified target. SPACs stand in contrast to a more traditional Initial Public Offering, in which shares of a company are sold to investors, and the sale is underwritten by a bank.

Virgin Galactic went public in Fall 2019.

This was a trial by fire for Virgin Galactic — their valuation of $1.5 billion dollars in July 2019, when the merger was announced, became subject to market forces in a way that valuations of privately held companies aren't. The liquidity has helped them; their market capitalization on October 31 was just over $4.8 billion dollars, which represents a 220% increase in value over fifteen months. It was also the first time a NewSpace company became publicly traded, which was a benchmark for the industry.

They say "what doesn't kill you makes you stronger," and a year later, Virgin Galactic is still in business. Furthermore, despite the effects of COVID-19 on the financial markets, Momentus Space (soon to be MNTS:NASDAQ) announced earlier in October that they will become publicly traded, and will also use a SPAC, Stable Road Acquisition Corporation (SRACU:NASDAQ), to enter the market.

Other entrepreneurs are interested in divesting, being bought out. There are two kinds of buyers: financial buyers, private equity, and strategic buyers, who are typically more established players in the same industry. An example of this in the legacy aerospace industry was when United Technologies Corporation bought Rockwell Collins in 2018. Analytical Graphics, Inc. and Roccor were also acquired by strategic buyers.

Redwire is a private equity-backed company owned by AE Industrial Partners. Redwire was formed when Adcole Space, one of AE Industrial Partners's portfolio companies, merged with Deep Space Systems, a new acquisition of theirs, this past June. Less than a month later, Redwire acquired Made In Space. Though it has private equity backing, Redwire is very much a strategic buyer — the value propositions on their website are exclusively technical. Redwire's October acquisition of Roccor, a satellite component manufacturer, speaks to two things beyond the technical synergies.

Private equity-backed company Redwire acquired Made In Space and Roccor.

First, private equity has a role to play in exits. It can function not just as a financial buyer, but also as a strategic buyer, when a private equity fund owns an appropriate portfolio company. Furthermore, this role includes enabling the growth of companies under a corporate umbrella. If this trend develops beyond Redwire, it will become a strategy commercial space companies can use to grow, without having to undergo the growing pains of a merger or acquisition.

Second, NewSpace as an industry is beginning to mature. The concept of a corporate umbrella is common among more established manufacturing-oriented industries, like food & beverage (Pepsi), and consumer packaged goods (Procter & Gamble). The development of commercial space ownership into structures that are recognizable in well-developed industries speaks to how seriously financial backers are taking successful space startups.

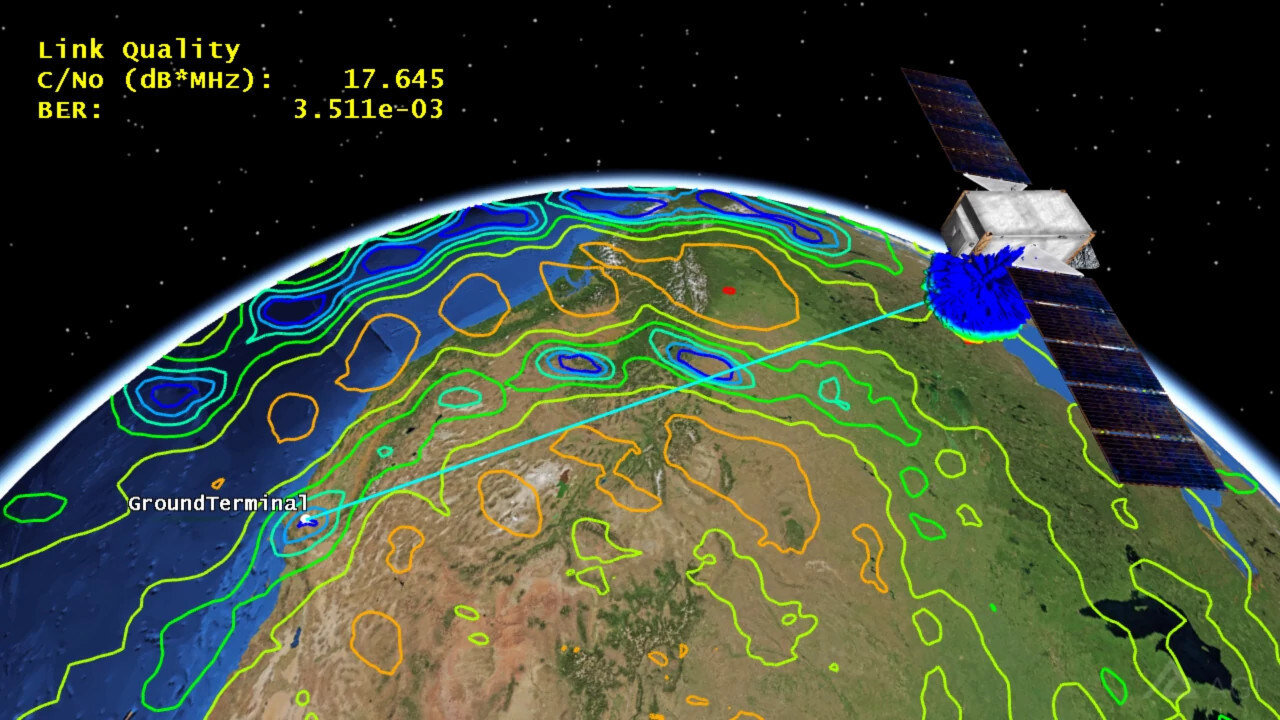

Satellite communication footprint with Ansys HFSS Antenna.

Ansys is a publicly traded engineering simulation and 3D design company with a market capitalization of around approximately $26 billion dollars. It is not an aerospace and defense company. Several of their products may be used in designing spacecraft, though they are not themselves an aerospace company. Their decision to acquire Analytical Graphics, Inc. (AGI), which makes the popular mission design tool Systems Tool Kit, as well as other aerospace-oriented software products. While AGI isn't what usually comes to mind first when thinking about the commercial space industry, the products that both they and Ansys produce are critical to many space missions. Their acquisition by Ansys is elegant, as Systems Tool Kit is an engineering tool that will enable the Ansys software suite to perform engineering analysis from the mission level, like trajectory analysis, all the way down to component design.

One of the takeaways from this transaction is that nonspace companies could be considered strategic buyers for space startups, and leverage their space capabilities to create unique value propositions. This is potentially very exciting, because it could provide an even more direct path to create value from the space sector in cooperation with other parts of the economy. In order for NewSpace as an industry to continue its rapid growth rate, companies in the field need to tie their own innovation to Earth-bound value propositions ever more tightly. This acquisition approach is one way of doing that.

What both of these events show, in a more general sense, is that the NewSpace environment is becoming more complex. There's more to the ecosystem of successful startups than billionaire-backed behemoths like Blue Origin and SpaceX, legacy-backed firms like Millennium Space Systems or ABL Space Systems, or attempting to become publicly traded like Virgin Galactic or Momentus. The emergence of more nuanced ownership structures that are becoming available to successful startups indicates that there is real interest among financial institutions and strategic buyers to engage with them not just on a technical level, but on a financial one as well.

←Click to return to “News” page.